By Rushdi Siddqui – www.btimes.com.my

“MASS media is the medium that carries the message to the masses and is responsible for controlling our conclusions.”

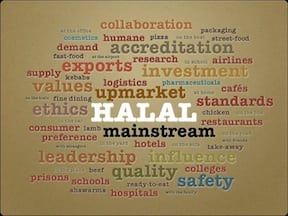

I’d like to dissect the above quote and see how the “transmission of message” is being coded and decoded by the Western media with respect to the halal industry and Islamic finance.

Neither the halal industry nor Islamic finance is time sensitive, hence, western/conventional media business editors often “bump” halal/Islamic stories for another day, regard them as insignificant or used only during “dry” periods – as they call it.

“Where is the Beef?” is the first question editors ask and the onus is on the author to convince them that there is indeed a story to be told and shared.

Halal/Islamic have been positioning themselves as not just for Muslims, but also an alternative to conventional, hence, the industry players must understand that they are benchmarked to developments in the conventional capital markets. While the merger of “faith and finance” and “food and faith” are intellectually interesting, it’s about business and real economy, as Tun Dr Mahathir Mohamad explained during a recent trip to South Korea, where certain evangelists were linking terrorist financing to Islamic finance.

Thus, as halal/Islamic are positioning themselves as “user agnostic”, business proposition and solution, yet the industry developments are not aligned, may be still embryonic even after four decades.

For business editors, here is a sample why halal/Islamic finance stories often don’t make it:

* M&A deals are commonplace in all the 10 economic sectors of an economy, many are cross border, and sizes of deals, cash/stock, are into billions of dollars. But, where is M&A in halal/Islamic finance? For example, consolidation among Islamic banks, in over banked markets like the UAE and Malaysia, is encouraged to achieve size, yet, consolidation seems like the extremely sensitive national security issue.

* The world is concerned about “real time data” that provide a pulse on how markets are performing in the US (S&P 500), World (MSCI World), technology (Nasdaq), Europe (STOXX), UK (FTSE), etc. Do the present syariah-compliant equity indexes provide a similar pulse to Islamic equity capital market(s)? No, for the above counterpart Islamic indexes, the dominating compliant compa-nies are western based, like Apple, Pfizer, ExxonMobil and not syariah-based (or by-law companies) like Al Rajhi, KFH, Bank Asya, Bank Islam, Dubai Islamic Bank, Mee-zan Bank, etc, as the former companies have no link to Islamic equity markets.

* The world has economic indicators, inflation, unemployment, trade numbers, etc, what and where are the Islamic economic indicators, as espoused by our Islamic economists for the last 40 years? Some/many will be same as “conventional”, however, there must be some that are different and meaningful! For example, as a guest speaker at IIUM (International Islamic University Malaysia) and INCEIF (International Centre for Education in Islamic Finance), I’ve been encouraging applied over academic research, as we need to have data that exhibits pulse of halal/Islamic.

The business editors are interested in Islamic M&A deals (Aston Martin), western entity issuing a sukuk (GE or IFC), syariah-based indexes, and relevant Islamic indicators, yet these are still work in progress. Obviously, if there are controversies, that are material, everyone is interested to break the news. It seems the news media are, for the most part, the bringers of bad news as bad news gets higher ratings and sells papers.

The same editors are simply not interested in another Islamic bank branch opening, or another fast food franchise with halal menu certified by a one-man shop, Islamic fund launched (unless very large), entity winning an award, etc. The above halal/Islamic finance news is competing with comments from central bank on inflation, growth, hostile acquisitions, stock exchange making a friendly bid for another exchange, the IMF news, and so on. The latter is what news audience want to read as it impacts their business or provides opportunities.

PR Firm

A possible way forward to address the message to the masses is to establish a well capitalised, dedicated and professionally staffed Islamic finance/halal communications/public relations firm with own offices (not rep offices) in the major Islamic finance/halal hubs of Malaysia, Dubai and London.

Its potential clients are the 500 plus Islamic financial institutions, banks, Takaful, iREITs, leasing companies, etc, plus government wanting to be a hub, industry bodies (IILM, IFSB, AAOIFI), major Islamic conferences (GIFF), etc. Surely, a trillion dollar industry (Islamic finance) and US$640 billion (RM1.92 trillion) industry (halal) need to have or hire a dedicated communications company to get the right corporate messaging out, build their brand awareness and loyalty, personality profiling, gain publicity, undertake crisis communications, train executives for media interviews, etc.

First Halal Suggestion

Since Islamic finance is miles ahead of halal industry in many areas, from global industry bodies to dedicated Islamic windows/units of large law firms, banks, consulting and accounting firms, index providers, etc, it is only natural for Islamic finance to take the the lead. For example, an Islamic finance/halal industry body needs to be established with government and private sector founding shareholders. Its mandate would be to coordinate and facilitate the convergence between the two interrelated sectors.

Conclusion

In order to capture the attention of the Western media editors, the IF/halal messages must carry the following sound bites:

* News is not repeating what is already known, Islamic banking is about prohibition against interest and pork or 500 Islamic institutions in 75 countries and growing at 15 per cent per annum, its wasted real space.

For halal industry, news about ingredients, certification, stunning, etc, is not as important as, say, large companies from Brazilian, Australian, and New Zealand, that sell billions of dollars worth of halal foods to the GCC are setting up operations in Abu Dhabi, Qatar or Saudi Arabia or issuing a Sukuk for construction of a factory for halal products.

* News is a business opportunity, job/wealth creation and improvement of lives for their readers

* News is about transparency of operations, access to senior executives, and timely submission of financial statements.

These type of stories would definitely provide “hook” to the (halal) beef !

The writer is global head of Islamic finance for ThomsonReuters based in New York