The agency is looking to internationalise its halal ecosystem and connect it to other parts of the world

by HARIZAH KAMEL / The Malaysia Reserve

THE Halal Development Corp Bhd (HDC), an agency under the International Trade and Industry Ministry, is helping industry players to join the halal economy.

This would increase Malaysia’s halal export and bring in more direct investment into the country’s halal industrial parks and increasing

quality employment opportunities for the people, thus opening the doors for economic recovery.

In a recent interview with The Malaysian Reserve (TMR), CEO Hairol Ariffein Sahari (picture) said for the halal ecosystem to be sustainable and robust, these two components are key — governance development and business development.

He stressed that both must move together as they play a major role in terms of developing the halal ecosystem.

“For HDC, as long as we focus on the real economic indicators — namely the contribution of halal industry to the GDP, exports and investments, quality employment, and strengthening halal integrity along the supply chain of halal products — I think we will never go wrong,” he said.

Competition and Mutual Recognition

Of all the halal economies, Malaysia has experienced the organic growth of developing the halal industry since 1974.

However, it was only after the year 2000 that halal was introduced into the Industrial Master Plan 2 (IMP2) and IMP3, where it became one of the key agendas in being the new source of economic growth in the country.

“Malaysia’s halal ecosystem is the most mature in the world and that gives us some advantages.

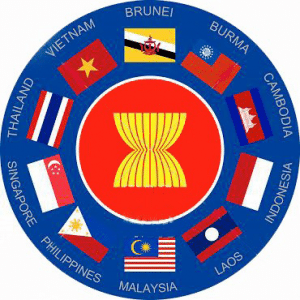

“We are looking to internationalise our halal ecosystem and connect it to other parts of the world. From there, we will create a mutual recognition which will promote more trade, investment and also good employment opportunities,” he said.

However, Hairol believed that Malaysia must not underestimate other countries’ growing capabilities and that linking our halal ecosystem to others is paramount for all.

“The market is huge but only less than 20% of the demand is met at the moment, so it leaves a huge gap yet to be filled. We foresee that if the whole world participates in the halal economy, the pie is more than enough for people to share.

“We must pay attention when people develop their own halal ecosystem. I see it as good competition, but most importantly, we have to find ways to work together and achieve mutual recognition to develop more business opportunities,” he said.

At the moment, HDC is actively promoting government-to-government collaboration and has signed several memorandums of cooperation with agencies representing their respective country.

Bouncing Back from A Pandemic

Before 2019, Hairol said HDC had direct investments recorded into its halal parks, between RM1.5 billion and RM2 billion every year without fail, created over 300,000 employment opportunities and around 10,000 certified halal companies.

As a result, the country achieved RM41 billion worth of exports against a target of RM40 billion.

Unfortunately, due to Covid-19, the halal supply chain was disrupted so even though the demand remained high, manufacturing and services activities got halted due to movement restrictions.

Hairol recounted that it was the worst of times for the manufacturers who had to import their halal raw materials as they could not produce.

“The direct impact is that production went down and the halal certification could not be renewed.

“It was very clear that last year, the export number and the number of certified halal companies were reduced to RM31 billion and about 7,000 with almost no investment going into our halal parks,” he said.

However, the halal economy started moving into a positive direction as evident between July 2020 and June 2021 whereby HDC observed more active export activities.

“If things continue moving along this path, we should be able to achieve around RM32 billion to RM33 billion export this year,” he told TMR.

Commenting on the conservative figure, Hairol said HDC is still vying to return to the pre-pandemic phase and observed that investments are also getting more traction.

He said during the second half of last year (2H20), HDC managed to record RM500 million new investment into its halal parks and during 1H21, HDC already received an additional RM400 million in investment. Interestingly, the majority of the investments are domestic.

“For us, it is a good indicator that our local players have remained resilient during the pandemic by expansion and also diversification of products as if they are ready to bounce back better.

“This is a positive sign to Malaysia’s halal economic recovery and is aligned with the country’s overall economic recovery,” he said.

Halal Integrated Platform

Although it is common knowledge that the size of the current halal market stood at around US$3.1 trillion (RM12.96 trillion), Malaysia’s export is still hovering around less than RM50 billion for the past decade.

Hairol said Malaysia has around 200,000 small and medium enterprises (SMEs) involved in halal businesses but the number of SMEs that are halal certified is still hovering around 9,000-10,000, which means that most of these businesses are outside of the halal supply chain and not participating in the economy.

Here lies one of the reasons for HDC to develop its one-stop online platform known as the Halal Integrated Platform so that all industry players can be connected.

“We want to bring in all 200,000 companies onboard the halal economy. When we dig deeper, out of that 9,000 to 10,000 certified halal companies, only less than 3,000 companies are exporters.

“Other than focusing on increasing the number of certified halal companies, we need to do extra work to increase the capacity and capability of our halal players to become exporters or at least become a successful domestic player,” TMR was told.

Malaysia has more than 360 organisations and institutions involved in halal ecosystem development and whatever is needed for companies or industry players to grow within the halal ecosystem, Hairol said there will be organisations or institutions (government or non-government) to assist them.

This would be the catalyst for more business transactions within the ecosystem, both online and offline, which indicates a vibrant business environment and making the ecosystem better.

The topic of employment among graduates was also brought up with local universities producing tens of thousands of graduates every year in halal-related programmes such as biotech, food tech, bioprocess engineering and more.

“These are graduates with expertise to become halal managers and executives later on. If HDC targets to transform all 200,000 companies to halal economy, each of these future halal companies must employ at least one full-time halal executive or manager.

“Just imagine the shortage that we have, in less than five to 10 years, the demand for our halal executives and managers will increase to easily 300,000 to 400,000 people.

“Unfortunately, based on our record, Malaysia has less than 20,000 trained halal executives and managers,” he revealed.

Sectors to Look Out For

For the most part, Hairol considered the halal concept as a value proposition that needs to be put forward and its players need to be convinced that their business can develop better with a halal brand.

“The strategy here is not so much about looking for new things but how we can give focus to sectors that can provide a good return in the long run,” he remarked.

HDC has identified food services and pharmaceuticals sectors to remain positive in the long run post-pandemic because of the new norms, adding that more emphasis will be given on the halal ingredient sector.

“The pandemic really taught us that the halal supply chain will be truly disrupted if there is a shortage of halal raw materials.

“So, this is what we want to focus on in the next three to five years. To us, whoever controls the halal raw materials will control the halal supply chain,” he said.

On pharmaceuticals, he said one of Malaysia’s strengths is exporting a lot of food supplements and medications to various countries in North America, Africa, East Asia and South-East Asia. This is something that HDC also wanted to improve further.

“We are currently discussing with a couple of our partners on how to increase the number of prescription drugs and biologics like vaccines but the development of new drugs or new vaccines take time.

“We need the right partners both local and international; we want an international partner who is willing to share its technology, and from the local side a partner who has the strength and resilience to absorb the long period to develop such a product,” said Hairol.

![UAE: 14th World Islamic Economic Forum in Abu Dhabi to Discuss Key Components of Global Economic Growth Event poster[27] copy](https://halalfocus.net/wp-content/uploads/2023/12/Event-poster27-copy-1.jpeg)