By Grace Randall – AHDB

The first Ramadan within the cost-of-living crisis begins around 22 March 2023 and research suggests it could look different from previous years.

With the population of Muslim consumers on the rise, demand for Halal meat has increased. However, we anticipate the types of meats Halal consumers choose to slightly switch this year away from lamb into mutton and chicken. This has already been anticipated by industry with strong demand and prices for ewes in recent months.

AHDB research in 2019 highlighted the demand for Halal meat and since then the Muslim population in the UK has increased further, up from 2.7 million in 2011, to 3.9 million in 2021 – making up 6.5% of the UK population, rising from 4.9% ten years prior. While London and Birmingham are the top locations, analysis by the Muslim Council of Britain indicates that 40% of the Muslim population of England reside in the most deprived fifth of local authority districts; nearly half a million more than in 2011.

Research from AHDB with YouGov1 suggests that half of Muslims have seen their household finances get worse in recent months (2022). However, this is slightly lower than the general population at 59%. The research also showed many Muslims claim their household finances were more impacted by the pandemic than we saw in the general population and the cost of living has been a continuation of the poor economic climate.

This also does not take in to account the extent to which households are impacted. Research by the Muslim Census suggests more than half of Muslims have experienced difficulty paying at least one bill in the last year and 65% have taken out some form of debt to manage everyday costs.

Cost of living impact on Muslim food shopping behaviour

As with the rest of the UK, the main ways Muslims plan on saving money are by eating out less and spending less on the weekly food shop (AHDB/YouGov 20221). Another way Muslim shoppers are having to save money is by skipping meals with a third claiming to have missed a meal to afford household bills (Muslim Census Nov-22).

AHDB analysis shows switching away from local butchers is much less likely for Muslim shoppers. This is the main shopping method for meat for the majority of Muslim consumers and they are twice as likely to shop at a butcher than the general population, with quality and good value the main drivers according to AHDB research. We also know the importance of assurance on Halal status and butchers are often more transparent than supermarkets. Although butchers tend to be slightly more expensive, halal consumers see butchers as better value than the general population, where shopping local is a bigger driver.

However, supermarkets are becoming more popular among Muslim consumers – particularly among younger generations, which has led many supermarkets to launch Halal ranges or stock Halal meat brands. These ranges and brands were worth £67 million in 2022 but remain a small part of the Halal market and very tiny part of the meat, fish and poultry market at less than 1% share (Kantar). However, Halal products are gaining share as they perform better than the market, with declines in volumes of 0.7% over the year to 19 February 2023 while total meat, fish and poultry volumes fell by 5.7% (Kantar).

Perhaps most concerning is the 19% of British Muslims who have turned to foodbanks in the last year with the majority of those using foodbanks in the last 3 months (Muslim Census). This compares to 11% of the total UK population (UK Parliament/Independent Food Aid Network).

What does this mean for lamb?

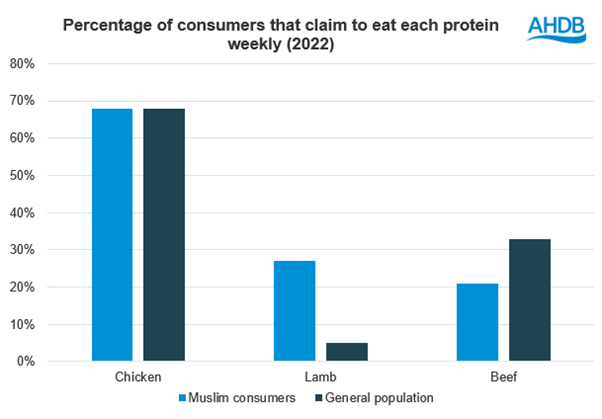

Muslims are much more likely to eat lamb than other British consumers throughout the year but particularly during festivals. Even though they make up 6.5% of the population, AHDB estimates Muslims account for nearly 20% of lamb volume sales.

Source: AHDB/YouGov 2022

Despite this over index in lamb consumption, one in five Muslims claim their household is eating less lamb while very few are cutting back on poultry (AHDB/YouGov 20221). In fact, the majority say they are eating chicken more often. This is similar to what we have seen at a total market perspective with shoppers switching away from more expensive cuts and proteins towards cheaper ones.

Therefore, we expect shoppers will continue to move some of their spend away from lamb in to mutton and chicken. When shopping for lamb and mutton, AHDB research shows chops are the most popular cut for Muslims. However, as chops tend to be more expensive, we could see shoppers move to cheaper cuts such as shoulder and mince. Even some cuts which are not widely available in supermarkets, such as lamb neck and heart are chosen by one in five Muslims due to their familiarity with these cuts and availability at Halal butchers.

Consumer demand is a key driver of farmgate prices and halal demand is important within this for sheep meat. Cull prices are strengthening while lamb prices remain steady showing a potential change in demand. For more information on how we think supply and demand may evolve over 2023 and what this means for prices, see our Agri-market outlook.

1 – Source: AHDB/YouGov fieldwork time periods – 15 Feb- 1 Mar, 4-16 May, 8-24 Aug, 18-30 Nov 2022

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/WC6UPQPLY5ECVKFOCP6WHWV3XU.jpg)