By Marco Tieman

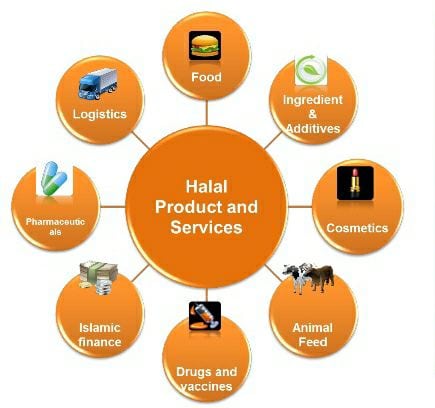

The halal industry is a fast-growing industry, today covering not only food but also non-food (such as cosmetics, pharmaceuticals, and modest fashion) as well as services (hotel, restaurant, café, logistics, and tourism). The halal industry is further evolving in leading halal markets in Asia, the Middle East and Africa. Being at the forefront of these halal megatrends will be important for brand owners to maximise sales and protect your licence to operate in Muslim markets. Brand owners need to understand these megatrends in the halal industry and be proactive on emerging halal requirements in order to build the world’s trusted halal brands.

1. Halal requires a supply chain approach

Halal requirements are moving away from a product approach, towards a halal supply chain approach. In a halal supply chain approach, halal requirements need to extend from source all the way to the point of consumer purchase (retail, restaurant, e-commerce). Although end-to-end halal assurance has been assumed by many advanced halal standards, enforcement has traditionally been limited, and often restricted to upstream supply of animal-based ingredients. This requires brand owners to conduct supply chain audits to determine their current compliance and draft a roadmap to implement end-to-end supply chains.

The biggest challenges are not upstream, but downstream towards the consumer, where the distribution flows become thinner and further away from the brand owner. Supply chain partners often lack proper halal standard operating procedures and risk management. Furthermore, downstream operations can be inspected by the Muslim consumer directly. Especially e-commerce is in many countries still immature, with a halal front office, but logistics and back office still conventional, mixing halal and non-halal. Indonesia, with the implementation of Law 33 by October 2024, is one of the first countries to implement a halal supply chain approach for imports and local distribution by law.

2. Halal industries benefit by locating in halal ecosystems

As reported by various halal market studies, the halal industry is a large (multi-trillion USD) and fast-growing industry. However, the halal industry has some systemic problems. First, the halal industry has supply problems. There is a lack of halal certified raw materials and ingredients with the right halal certificates. Second, the halal industry is dependent and dominated by companies from non-OIC countries, which are often reactive to halal requirements, creating long and instable halal supply chains. Third, there are many different halal certification bodies in the world, using different halal standards and certificates, with a lack of mutual recognition. There is an underlying system in place of recognition of foreign halal certification bodies by halal authorities from (Muslim) majority countries that is dynamic with regular mutations, making global halal supply chains instable and extremely complex to management.

To effectively address supply problems, simplify halal certification for halal industries, and create more sustainable and stable halal supply chains, supply chain participants benefit by physically producing/operating from advanced halal ecosystems. Advanced halal ecosystems started first in Malaysia more than 10 years ago, and are now also being developed in other Muslim (majority) countries like Indonesia.

3. Establish halal key performance indicators

Traditionally halal has been considered the responsibility of the internal halal committee, a department responsible for the implementation of the halal assurance system on behalf of the organisation. The internal halal committee has some operational indicators, like number of halal-related complaints, halal incidents, number of halal audits conducted, percentage of staff trained on halal, etc. However, measuring these indicators does not allow the internal halal committee to further evolve and bring halal excellence for a company to the next level.

Halal is not the sole responsibility of the internal halal committee but the end responsibility of top management, which requires key performance indicators measured by top management. Halal performance needs to be systematically measured by companies in order to manage and control a halal management system. For this, a halal risk report could be essential intelligence to feed top management and board of directors with halal key performance indicators and performance data. Examples of halal key performance indicators developed by LBB International are: halal maturity, halal trust, halal reputation index, licence to operate, and halal rating.

4. Companies need to build a strong halal DNA

The continuation of the Palestine-Israel conflict is increasingly impacting global brands with a possible link to Israel, which are being actively boycotted by Muslim consumers. The halal reputation and sales of several multinational companies have been negatively affected over the past year as a result, which has been noticed by top management, board of directors and shareholders. As Muslim markets are attractive consumer markets in terms of size and growth, this requires in particular action by multinational consumer brand owners from non-Muslim countries.

Halal requirements are not just addressed from an ingredient point of view, but should really be the entire business value chain. Companies need to focus on building halal reputation capital, a strong halal DNA, in order to receive trust and loyalty from the Muslim consumer. Companies must develop a halal strategy to bring halal into their business value chain, draft a practical roadmap to implement a halal value chain, and measure progress made with the right key performance indicators.

In conclusion

The halal megatrends of 2024 are reshaping the halal business environment and present challenges for companies with traditional approaches, and opportunities for companies that adapt. The halal industry is a fast-growing but dynamic industry that needs to be well understood in order to be successful in Muslim markets in Asia, the Middle East and Africa. As companies shape their business strategies for Muslim markets, it will be essential to work on your halal supply chain, play a role in halal ecosystems, implement the right halal key performance indicators, and build your company’s halal DNA.

Dr. Marco Tieman Dr. Marco Tieman is the founder and CEO of LBB International and author of ‘Halal Business Management: a guide to achieving halal excellence’.