By Dr. Marco Tieman

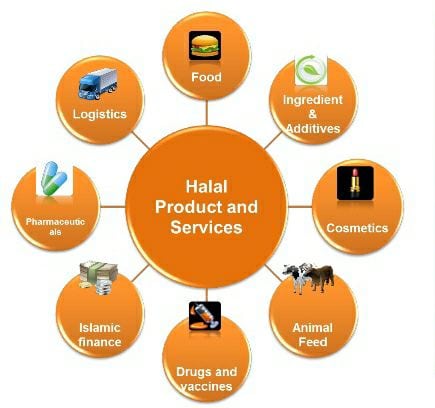

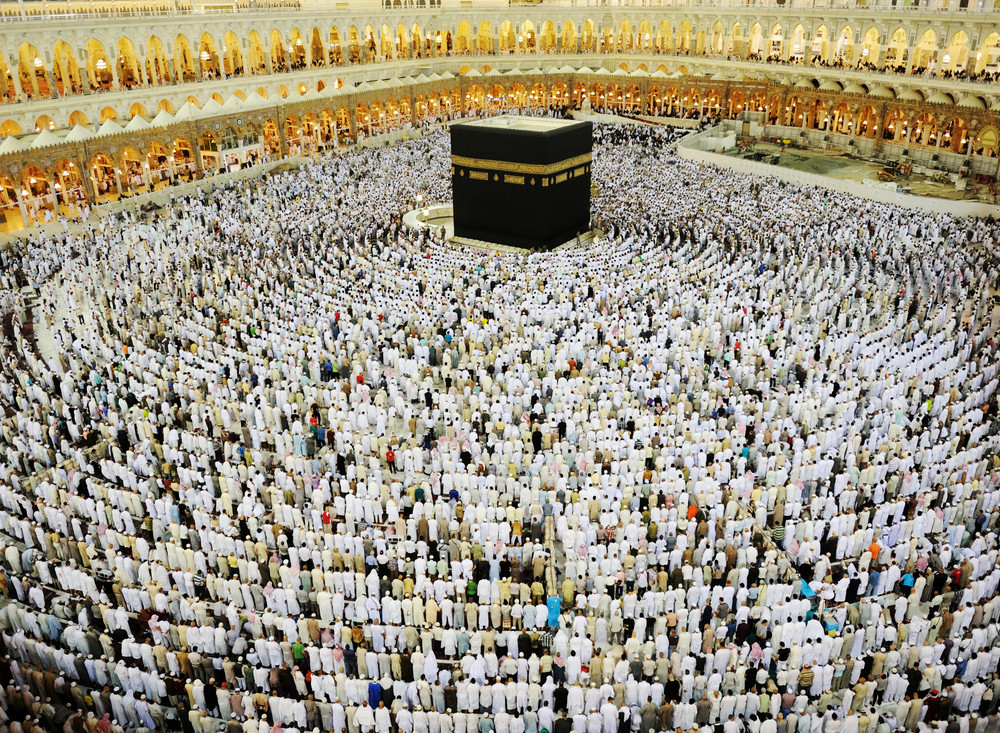

Islam is the world’s fastest growing religion, due to young age structure and relative high fertility rate. Pew Research projects that sometime around 2075, Islam will be the world’s dominant religion. As a result, the halal industry is a fast-growing industry, covering not only food but also non-food (such as cosmetics, pharmaceuticals, and modest fashion) as well as services (hotel, restaurant, café, hospital, logistics, media, travel and tourism). The halal industry provides an attractive market to serve, few industries can afford to ignore.

The halal industry is a dynamic industry with differences in local and regional needs but also common trends. Being at the forefront of these halal megatrends will be important for brand owners to maximise sales and protect your corporate reputation in Muslim markets. Brand owners need to understand these megatrends in the halal industry and be proactive on emerging halal requirements in order to build the world’s trusted halal brands.

1. Halal requires a supply chain and increasingly a value chain approach

Halal requirements are moving away from a product approach, towards a halal supply chain and value chain approach. In a halal supply chain approach, halal requirements need to extend from source to the point of consumer purchase (retail, restaurant, e-commerce).

End-to-end halal supply chains are inherently unstable and halal integrity performance unpredictable, due to different halal supply chain practices or lack of any halal practices (like in sea freight and airfreight). This is not only a problem for the Muslim consumer, but also for brand owners, halal certification bodies, and governments (from OIC countries).

Although end-to-end halal assurance has been assumed by many advanced halal standards, enforcement has traditionally been limited to upstream supply of animal-based ingredients only. Indonesia has changed this paradigm, where under Law 33 it made halal supply chain mandatory for food since 17 October 2024, which also will be implemented for cosmetics and pharmaceuticals on 17 October 2026 onwards. It is expected that other OIC countries will follow with similar regulations in the coming five years.

A first step for brand owners is to conduct a supply chain audit to determine their current gaps and draft a roadmap to implement end-to-end supply chains. The halal assurance system should be extended to cover halal control points throughout the brand owner supply chain or even better: to develop a halal supply chain blueprint for the organisation.

The halal value chain is an emerging requirement for brand owners serving Muslim markets, where Islamic values are addressed throughout the entire business value chain. There have been clear warning signs indicating this trend, namely the boycotts in Muslim countries of products that are halal certified from brand owners that are supporting or had any association with Israel. In Indonesia and Malaysia some of these brand owners have lost 30-50% of their revenue and have been closing outlets since.

In a halal value chain approach it is critical that the halal assurance system defines the actual halal assurance activities for each halal value chain activity of the company.

It is good to realise the complexity of the supply chain, where halal value chains are connected in a so-called halal value chain network. Alignment is essential between the supply chain partners value chain and the brand owner’s halal value chain. Taking a ‘halal by design’ approach is recommended, which can best be supported by a halal supply chain and value chain blueprint for the brand owner.

2. The development of advanced halal ecosystems in Asia and the Middle East

As indicated by various halal market studies, the halal industry is a multi-trillion USD industry with solid annual growth figures due to the growing Muslim population.

The main problem of the halal industry is not its market size and growth, but its shortage of raw materials which have become a serious bottleneck for the halal industry and limiting its full potential.

For halal certified food, cosmetics, and pharmaceuticals there are stringent requirements on its raw materials (and primary packaging) used, that need to comply with Islamic law. Research shows that for all three halal industries there is a systemic shortage of raw materials and at the same time a high dependence of supply from non-OIC countries. Leading halal certified consumer brands are from non-Muslim countries as well.

As a result, there is a need for capacity development in OIC countries to create foremost supply of raw materials but also production of consumer products. As halal is moving from a product to a supply chain and value chain approach, there is at the same time an urgent need to simplify halal for industries.

Advanced halal ecosystems could provide the answer to these challenges in building production capacity and create synergy for halal industries in OIC countries. Malaysia has been pioneering the halal park concept, which started about 15 years ago. Today also Indonesia is developing halal parks. Although currently most halal parks are just dedicated industrial zones for halal industries.

There is a need for more complete halal ecosystems that can boost production of halal raw materials and end products, halal exports, and that can create synergy advantages for companies and their halal supply chain and value chain.

These halal ecosystems can become the birthplace of new halal brands. It is expected that advanced halal ecosystems will be developed in the coming 5 years in particular in Asia and the Middle East. Therese halal ecosystems provide an opportunity to increase the role of OIC countries in the halal value chain.

3. Halal blockchains introduced by halal certification bodies

Discussions at halal conferences over the past two years are indicating the growing importance of halal certification bodies to better protect the halal logo on products and services certified by halal authorities. There has been an increase in fraud cases over the past 10 years in OIC countries that have damaged the trust of the Muslim consumer in products and services that carry a halal logo. There is a growing consensus among halal certification bodies that technology should be applied to better protect the authenticity of the halal logo for the Muslim consumer.

It is expected that the QR code in combination with blockchain (or similar technology) will be introduced by leading halal certification bodies in 2025 onwards. This will allow better traceability and enforcement of the halal authenticity of halal certified products and services. QR technology will also allow brand owners in non-OIC countries to share halal certification status with the Muslim consumer without showing the physical halal logo on halal certified products.

This method could be more practical for brand owners to communicate the halal status to the Muslim consumer, when serving non-Muslim countries with a growing Islamophobia (like in Europe) instead of not communicating the halal status at all on the product label or restaurant outlet.

4. Rise of Halal Compliant Ports

According to UNCTAD, over 80% of the volume of international trade is carried by sea.

A big share of food, cosmetics and pharmaceutical ingredients and end products are imported into OIC countries.

For OIC countries the halal integrity of imports into their country are essential to provide assurance that the food, cosmetics, pharmaceuticals and other consumer products available in their market meet the requirements for Muslims based on their Islamic school of thought, religious rulings (fatwas), and local customs. Ports and shipping are an evident missing link in end-to-end halal supply chains today.

Although you would expect halal compliant port initiatives to start from Muslim (majority) countries, instead Europe has been the birthplace for halal compliant port initiatives by the Port of Rotterdam (the Netherlands), Port of Zeebrugge (Belgium) and Port of Algeciras (Spain). In Asia, Malaysia pioneered halal compliant port initiatives by Northport, Penang Port, Johor Port Authority and Kuantan Port.

Although there is currently no dedicated halal compliant port terminal standard, general halal standards and halal supply chain management system standards have been used as a halal framework for reference and certification. Currently OIC/SMIIC is in process of finalising a port module under its international halal supply chain management system standard OIC/SMIIC 17, which is expected to be launched in 2025.

Following the example of European ports in recognising the importance of halal compliance of port operations, it is expected that more halal compliant port terminals will be developed in Muslim (majority) countries in Asia, Middle East, and Africa. Shipping lines will also launch in the coming years halal maritime logistics solutions to provide door-to-door halal transportation solutions via sea, meeting halal import requirements of OIC countries.

In conclusion

The halal megatrends of 2025 are reshaping the halal business environment and presenting opportunities for businesses in addressing problems, needs and emerging requirements in the halal industry.

1. Halal requires a supply chain approach and increasingly a value chain approach when serving Muslim markets in Asia, the Middle East and Africa. Taking a ‘halal by design’ approach is important for brand owners, which can best be supported by a halal supply chain and value chain blueprint.

2. Advanced halal ecosystems are being developed in Asia and expected also in the Middle East in the coming 5 years to address shortages of raw materials and claim a bigger role of OIC countries in the halal value chain of food, cosmetics, and pharmaceuticals. These halal ecosystems can simplify halal requirements, better organise halal supply chains and value chains, as well as better meeting stringent sustainability requirements for exports.

3. There is a growing consensus among halal certification bodies that technology is required to better protect the authenticity of the halal logo on products and services. It is expected that halal authorities will be using the QR code in combination with blockchain technology (or similar technology) to better communicate and control the authenticity of the halal logo, which can also be useful for sharing the halal status in non-Muslim countries without showing the actual halal logo.

4. It is expected that more halal compliant port terminals will be developed in Muslim (majority) countries in Asia, Middle East, and Africa. Shipping lines will also launch in the coming years halal maritime logistics solutions to provide door-to-door halal transportation solutions via sea, meeting halal import requirements of OIC countries.

Dr. Marco Tieman

Dr. Marco Tieman is the founder and CEO of LBB International and author of ‘Halal Business Management: a guide to achieving halal excellence’. He has been advisor in Asia, Europe and the Middle East on halal procurement, production, supply chain, value chain and ecosystems. He is also a part-time academic with universities in Indonesia and Malaysia, conducting research on halal procurement strategy, halal supply chain management, halal ecosystems, and halal risk and reputation management.