Justin Timberlake once said: “Yesterday is history, and tomorrow is a mystery.” One way to solve a mystery is by 1) deep dive research or “Googling” it; 2) Sherlock Holmes deductions; or 3) suggestions based upon industry experience.

As we look forward to 2014, we, in Islamic finance and the halal industry, have control of some aspects of our destiny, others we hope we have control over, and, still others, we can only say “Insha’llah”.

Islamic finance is a subset of ethical finance, which is a subset of conventional finance, hence, what happens at the top has a trickle down impact. The green shoots of economic recovery in the west/China have a confidence inducing effect on Islamic finance, hence, we are hearing much chatter about the movement in UK (David Cameron statement on sovereign £200 (RM1,073.96) sukuk), parts of Africa/Commonwealth of Independent States, Islamic Development Bank attempting to map halal in Organisation of Islamic Cooperation (OIC), Islamic economy conferences, etc.

Control On Islamic finance conferences, there are two things I would like to see for 2014; first, sponsors should offer cost sharing reductions premiums, please, no more thumb-drives! Sponsors, even conference organisers, should outsource products made by indigenous people and place in the conference bags. For example, several years ago, South Africa-based Oasis Asset Management Ltd gave out animals made of colourful wiring made by local people, and I still cherish mine!

Second, Dubai’s Global Islamic Economy Summit (GIES), financially challenged all stakeholders to address predetermined challenges by way of financial rewards, ie, bounty for solutions! The important Global Islamic Finance Forum will take place in Malaysia in 2014, and I hope something comparable is offered.

Malaysia hopes to become a knowledge-based, high income country by 2020, which means availability of risk capital (opposite of today’s Murabahah’s centric Islamic finance) as part of an enabling equity culture. To build a “silicon valley” environment, reverse linkage from Palo Alto, does not mean investing in venture capital firms in the valley, but rather building a “Silk-road Valley” for establishing Malaysia as beachhead of technological innovation, like common OIC diseases, and linking it to the 56 Muslim countries.

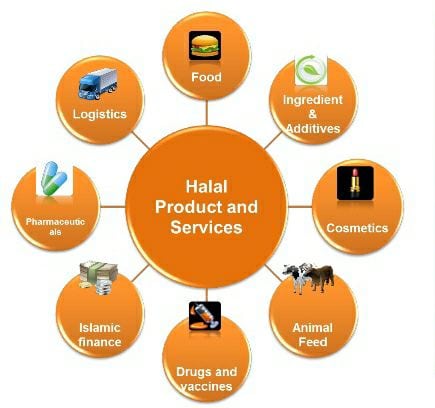

Malaysia needs to step up its approach for halal industry, because it is not a Halal hub (net importer of beef, chicken, etc), but, having Malaysian standards, a halal hub division department of Islamic Development Malaysia, Halal Industry Development Corp, etc, makes it a regulatory/IP halal hub, much like Bahrain and regulations for Islamic finance. Dubai’s ambition of being a halal hub, is part of the Islamic economy capital.

The US is actually a halal hub, as the largest exporter of meats/live animals to OIC, US$17.3 billion (RM56.85 billion), in 2012, according to Thomson Reuters report of State of Global Islamic Economy. It may be time for Malaysian entities, like Federal Land Development Authority, to look beyond (real estate in) the UK and (cattle ranches in) Australia for direct investments in the US for agro-food areas to address domestic demand, nearly US$5 billion, and exporting to Gulf Cooperation Council.

Islamic finance needs a rebranding and halal needs a repositioning. Sheikh Saleh Kamel, one of the founding fathers of Islamic finance, recently stated it should be called “ethical” banking as it’s part of an Islamic economy. But, in calling it ethical, it implies others are possibly unethical, hence, may be better to call it, as they do in Turkey, participation finance.

Halal seems to be linked to be only for Muslims (much like Islamic finance perception) and the religious slaughter, but, in reality, it’s about two important attributes: organic/wholesome and traceability.

The focus should be on what happens before the “knife”, the humane treatment of animals and feed ingredients, hence, linkage to ethical consumption community.

Finally, to an outsider following financing news in Malaysia, the country comes across as only about Islamic finance, be it sukuk issuance, number of Islamic funds, new Shariah screening, Islamic banking assets (20%), Islamic Financial Services Board, etc, These are “ethical” lubricants for an economy, not the economy itself.

Conclusion: To lead requires aspiration, inspiration, and perspiration. The year 2013, completed 30 years of stage one Islamic finance, now Malaysia has to better itself and compete with others for Islamic finance and Halal 2.0.

Rushdi Siddiqui, a former global director at Dow Jones Indexes and global head at Thomson Reuters in Islamic finance, is now president/ ED of a (halal) US-based agro-food company.