Onwards and upwards in 2018 – predicting the year ahead for the Halal Food industry

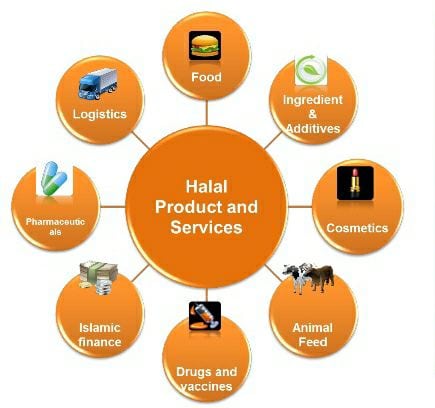

Halal has been recognized widely as a “hot” trend in the food industry – one that companies across the global food value chain are increasingly addressing, and not surprising given the industry’s scale — a $415 billion Halal certified food and beverage industry in 2015 (according to the State of the Global Islamic Economy Report 2016/17, prepared by Thomson Reuters in collaboration with DinarStandard) — with robust growth dynamics that could see it surpass $1 trillion within the next five years. Spend on Halal Food is a subset of a broader $1.3 trillion spend by Muslims globally on Food and Beverage in 2016 (according to the Islamic Economy Report 2017/18, prepared by Thomson Reuters in collaboration with DinarStandard).

Halal has been recognized widely as a “hot” trend in the food industry – one that companies across the global food value chain are increasingly addressing, and not surprising given the industry’s scale — a $415 billion Halal certified food and beverage industry in 2015 (according to the State of the Global Islamic Economy Report 2016/17, prepared by Thomson Reuters in collaboration with DinarStandard) — with robust growth dynamics that could see it surpass $1 trillion within the next five years. Spend on Halal Food is a subset of a broader $1.3 trillion spend by Muslims globally on Food and Beverage in 2016 (according to the Islamic Economy Report 2017/18, prepared by Thomson Reuters in collaboration with DinarStandard).

What we have seen thus far is the industry maturing, albeit still in its very early stages – Halal-focused companies that are relative newcomers in the Food Industry are showing rapid growth and are reaching a tipping point in their scale (Halal Guys, Saffron Road, Al-Islami Foods, among many examples), regulation is becoming more streamlined, and consumer needs are being increasingly addressed, fueled by startups offering innovative products and services.

So, what does the year ahead have in store for us? Four important predictions…

(1) Private equity will get involved in a big way – and its about time

There have been notable private investments in the last few years such as Janan Halal Meat receiving GBP $30 million in 2016 and in 2017 there were also been notable crowdfunding investments for the emerging startups that have shown substantial promise.

But Halal Food is largely unexplored by private equity firms and that has to change and what is often not reported, understandably, is the value of deals currently in the pipeline. Halal has already gained the attention of investors, but deals need to happen.

Prediction: There are over $100 million worth of investments in the pipeline and a part of this will be realized in 2018. So, we predict 2018 is the year to start the ignition, with at least one $20 million+ investment in a medium-scale but high growth Halal Food company – beginning the race to our 2030 vision – a $1 billion+ revenue Halal Food company with a global footprint.

(2) Companies will clamor for the Muslim dollar, driving a step up in the specialized marketing of Halal and related products

There are a plethora of multinational companies addressing the Halal opportunity – including manufacturers and suppliers such as Nestle, Cargill, and Abbott; Retailers, including Walmart and Costco, and Foodservice establishments, including KFC and Elevation Burger. They realize the value of Muslims and have incorporated robust Halal assurance processes, whether directly in their operations or in their careful vetting of suppliers.

The ability to reach the Muslim consumer and ensure their loyalty, in a dedicated way, is increasingly important – and not just restricted to Food – but extends to a broad range of lifestyle products and services, spanning clothing, travel, media and financing products and services, and accordingly dedicated online marketing platforms have emerged, albeit primarily through self-funded startups (notably Muslim Ad Network and Halal.Ad)

Prediction: 2018 will see a spectacular spotlight shining on the marketing value of Muslim consumers, through high-profile events, robust media coverage and research reports, serving as a “tipping point.” Accordingly, we predict there will be substantial investments in 2018 (exceeding $5-10 million) in at least one of two core areas (i) a dedicated online advertising platform that targets Muslim consumers through specialized channels (Islamic-themed media websites, social media pages, television channels) and (ii) a loyalty program that connects Muslim consumers with tailored products and services meeting their lifestyle needs. The broader link with related ethical markets such as organic will also be better established in the coming year.

(3) Even more innovation is expected in the coming year as Halal Food startups gain traction

The uberization of Food has finally reached the Halal Food industry – with the rise of specialized startups that offer added assurance about Halal Food – and judging by the buzz, media recognitions and crowdfunding successes, they’re doing great.

The “Halal-tech” offering is broad and very recently developed (over the last two years) – Ordering Halal Food for delivery (Halal Eat), Finding and booking a table at a high quality Halal restaurant (Halal Dining Club), and Having Halal Meat and prepared meals delivered to your door (HalalDash).

The emergence of dedicated accelerators focused on Islamic Economy will precipitate further innovation (notably Affinis Labs and Elmangos, and a recently launched new initiative by DinarStandard called Goodforce Labs).

Prediction: More Halal Food startups will emerge in 2018, mirroring the substantial tech innovation in the conventional food industry (with notable gaps in the Halal Food industry, such as Sharing Economy platforms such as Umi Kitchen, and Local distribution apps, such as Local Bushel, that connect restaurants directly with farms). We predict that at least $5 million will be invested in Halal Food-oriented tech startups in the coming year, an important next step, and dedicated accelerators will play a key role in facilitating such investments.

(4) Halal Food regulation will take important steps towards the rationalization of standards, with blockchain entering the mix

The regulation of Halal Food certification still lags comparable well-established certifications within the food industry (notably food safety, organic, and kosher). The core missing pieces in Halal Food regulation are multiple standards, limited oversight of certification bodies and limited mutual recognition, all of which frustrates suppliers, limits market access across different Muslim-majority countries, and has resulted in numerous scandals damaging consumer confidence.

The formation of the International Halal Accreditation Forum (IHAF), spearheaded by the UAE, has seen many accreditation bodies sign up for mutual recognition, pushing the industry towards greater alignment, and greater oversight of certification bodies. This is a promising first step in upgrading Halal Food regulation. However, much more needs to happen to bring Halal Food on a par of excellence with other certifications.

In other areas of development, Halal products testing is becoming more sophisticated, and will become an important area of ensuring compliance, carried out by specialized institutions.

Prediction: 2018 will see an industry push for fewer, harmonized standards. Those standards may allow for differences, such as stun vs. non-stun, and machine vs. hand slaughter, but the ultimate outcome (may not be fully realized in 2018), is that the number of standards will be discrete, and enforced by certifiers, in turn overseen by accreditation bodies. This year will also see a breakthrough of blockchain in Halal compliance with a number of “Halalchain” initiatives in the pipeline.

Conclusion: The Halal Food industry is at an exciting time in its development, fast approaching $1 trillion, with substantial opportunities for companies and investors across the Food value chain to access and build brand loyalty among a vast values-based and globally connected consumer segment. Be a part of the industry’s development in 2018 and incorporate Halal in your growth strategy.

Please feel free to get in touch – my email address is haroon.latif@dinarstandard.com

Haroon Latif is extremely passionate about Ethical Business and through his combined roles at Goodforce Labs and DinarStandard, he is helping build the ethical business leaders of tomorrow, channelling all his passion, dedication and over 10 years of experience across Strategy Consulting, Venture Management and Accounting.